Last week’s price action analyses of BTC & ETH were spot on. Today we are here to look at the SOL price. In the midst of a bullish wave sweeping through the crypto market, many top altcoins are seeing impressive gains in their value. Solana (SOL) has been particularly noteworthy, with its price jumping by over 7.25% in just one day, breaking through a crucial resistance level.

SOL Price Driving Up

For a brief period, the SOL price traded in a narrow range between $90 and $100, signaling a lackluster market performance. However, as market volatility increased, bullish momentum waned, leading to a breakdown on the charts.

Despite this, SOL managed to hold above the support level of $80.19, prompting a rebound in its value. This bounce-back saw the price surge by approximately 35%. Although it faced resistance at $108.18, SOL found support at the Cross EMA 200-day level, resulting in a period of consolidation.

We jumped in a couple of trades along the way, just like yesterday in the move-up. We entered at 108 in case it would break resistance, which it did. In these scenarios, we like to use a tight stop-loss.

In a recent attempt to break through its resistance level, SOL faced resistance from bears, causing a temporary pullback. Nevertheless, with the EMA 50-day acting as support, the price bounced back, rising by over 7.5% in the past 24 hours. This surge indicates a significant uptick in buying sentiment across the cryptocurrency industry.

The Burning Question Now is: Will SOL’s price drop again?

Technical indicators, such as the MACD, suggest ongoing bullish momentum, with the histogram showing a steady rise and the averages converging bullishly. This indicates the potential for substantial price action in the near future.

If market momentum continues and SOL breaches its resistance level of $117, it could test higher resistance at $125 by the weekend. Sustaining this price level could pave the way for further upward movement, potentially reaching $135 in the weeks ahead.

However, if bears regain control, SOL may retreat to test support at $108.18. Further downward pressure could push it towards the $100 support level this month.

Farm Dex Airdrops While Trading

Now, if you are looking to make some trading moves. You should consider farming some Dex airdrops while you are at it. We have a full list of them here.

Just yesterday, while we were longing for the Solana trade on Bybit. We also added a small position on LogX to farm a future airdrop. If you decide to use this Dex, use referral code F9AE028E to get some bonus points.

If you long 100$ at 20x leverage, that’s a $2k opening and $2k closing position which is $4k volume. Try to make 13 trades like that to get to 50k volume which could add up to a decent size airdrop.

Our Current Solana Trade

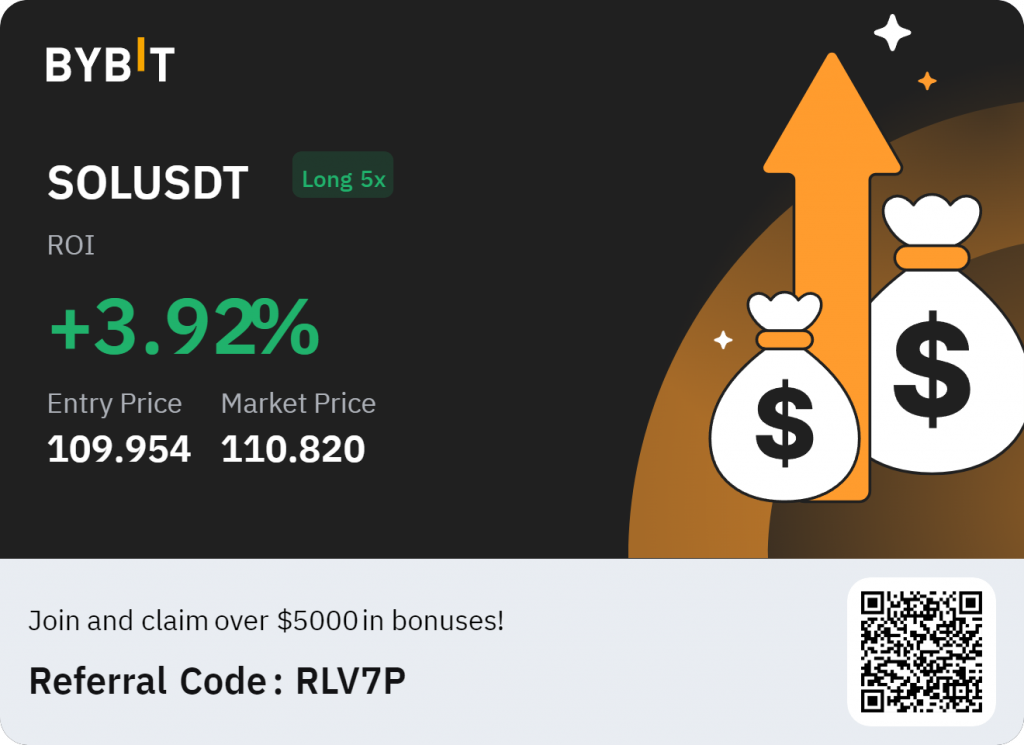

After we closed yesterday’s trade at $113.61, we reopened a long order at 109.95.

The previous resistance level between 108-110 has been tough to break. And we longed here on the retest of those levels. Our stoploss is set at $107. If we break below we might retest the bottom of $100 again.

Our take profit is set at $121 here.

Final Thoughts

In conclusion, while the SOL price’s recent surge is promising, the cryptocurrency market remains volatile, and price movements can swiftly change direction. Investors should keep a close eye on key support and resistance levels to gauge the trajectory of SOL’s price in the coming days.

If you enjoy our content, you can support us by signing up for a Bybit Account with our referral link. Don’t forget to claim your bonuses if you buy/sell or trade crypto.

You might also like our other trading content.