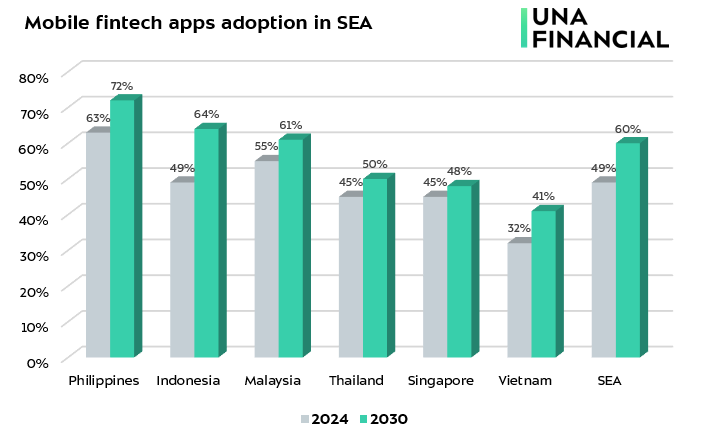

Mobile fintech penetration in six Southeast Asian countries has more than tripled since 2019, reaching 49 per cent in May 2024, as shown in a recent research by UnaFinancial.

The Philippines is at the forefront with 63 per cent, followed by Malaysia at 55 per cent, Indonesia at 49 per cent, Thailand at 45 per cent, Singapore at 45 per cent, and Vietnam at 32 per cent.

According to the report, the penetration of mobile fintech apps is projected to increase to 60 per cent by 2030. The highest levels are anticipated in the Philippines at 72 per cent, Indonesia at 64 per cent, and Malaysia at 61 per cent.

Also Read: How fintech is disrupting the Southeast Asian payments market

“The leadership of the Philippines can be attributed to several factors, including a significant portion of the unbanked population, regulatory support for digital financial technologies, a tech-savvy younger population, and increasing mobile and Internet usage,” explained analysts at UnaFinancial.

“Indonesia has also shown remarkable growth in fintech user adoption over the past five years. The adoption of mobile fintech apps has risen from 9 per cent in 2019 to 49 per cent in 2024. Similar to the Philippines, Indonesia is actively promoting fintech with government support and a significant unbanked population,” they added.

The key segments of fintech apps are digital wallets and payments at 35 per cent, followed by mobile banking at 18 per cent. The fastest-growing segment is lending apps, which have increased from 1 per cent in 2019 to 5 per cent in 2024.

Investing and cryptocurrency trading apps have the lowest penetration levels at 2 per cent each, likely due to decreased investment activity amidst global economic instability.

The analysts analyzed data from data.ai on the active users of fintech applications starting from May 2019. The sample included 8,740 apps (iOS + Android) across six Southeast Asian countries (Singapore, Malaysia, Thailand, Indonesia, the Philippines, and Vietnam).

Also Read: A new breed of fintech payment is here to slay the game

UnaFinancial is a group of companies developing digital financial solutions in Asia and Europe. Claiming to have served over 14 million clients and provided access to over US$1.5 billion in loans since its establishment.

The post Philippines leads mobile fintech app adoption in SEA: Study appeared first on e27.