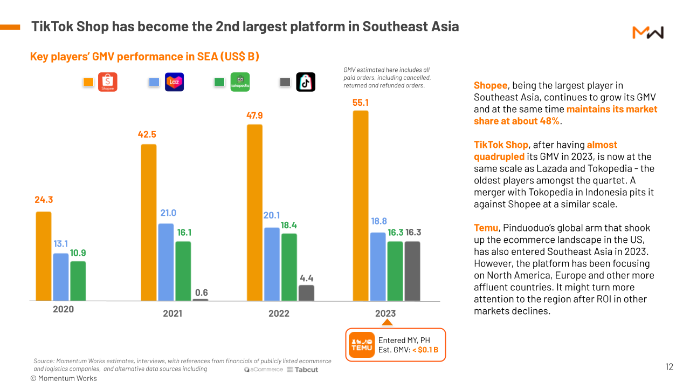

TikTok Shop has surpassed Tokopedia to become the second-largest e-commerce platform in Southeast Asia in 2023, as reported by Momentum Works.

Shopee still holds its dominant position with a GMV of US$55.1 billion, commanding a 48 per cent market share.

In 2023, TikTok Shop quadrupled its annual GMV to US$16.3 billion, putting it on par with Lazada and Tokopedia. The merger of TikTok Shop with Tokopedia now positions it as a competitor to Shopee at a similar scale.

Also Read: TikTok vs Shopee EC battle in SEA: Unveiling strategies for startups

The report also highlighted that while Shopee, Lazada, and Tokopedia downsized their workforce from 2022 to 2024, TikTok Shop expanded its workforce to over 8,000 employees since December 2021. This indicates a strategic approach geared towards sustainable growth in the region.

The insights were revealed in Momentum Works’s ‘The Ecommerce in Southeast Asia 2024’ report, which offers in-depth analysis of the e-commerce landscape in the region, including logistics and competitive players.

The report also indicates that Southeast Asia’s e-commerce market continued to grow impressively, reaching a total GMV of US$114.6 billion in 2023, marking a 15 per cent increase from the previous year.

Indonesia remains the largest e-commerce market in the region, contributing 46.9 per cent to the total GMV. However, the growth rate in Indonesia was the slowest at 3.7 per cent among the Southeast Asian countries.

Vietnam and Thailand emerged as the fastest-growing markets, with GMV increases of 52.9 per cent and 34.1 per cent year-on-year, respectively. Vietnam has now overtaken the Philippines to become the third-largest e-commerce market in the region.

The Philippines, Malaysia, and Singapore also saw double-digit or close to double-digit growth rates in their e-commerce markets.

Also Read: The evolution and regulation of social commerce in Indonesia: The TikTok Shop ban

Pinduoduo’s global arm, Temu, entered the Southeast Asian market in 2023, aiming to expand its reach. While it faces challenges entering Indonesia with its current model, the platform may focus more on the region following declining returns in other markets like North America and Europe.

The report also outlined four key trends impacting Southeast Asia’s e-commerce landscape:

Live commerce: Leading Key Opinion Leaders (KOLs) in Vietnam, Thailand, and Indonesia are achieving significant sales figures through live sessions.

Generative AI: E-commerce platforms in the region are adopting generative AI applications to enhance user experience and operational efficiency.

E-commerce enablers: Many e-commerce enablers are diversifying their business models to address market challenges and reduced brand market shares on platforms.

E-commerce logistics: Third-party logistics providers are facing increased pressure as platforms start in-sourcing parcel delivery services.

Jianggan Li, Founder and CEO of Momentum Works, emphasized the dynamic nature of the e-commerce landscape in Southeast Asia and the importance of innovation and adaptation for success. He highlighted the impact of trends like generative AI and live commerce in reshaping the industry and driving growth opportunities for businesses in the region.

Also Read: GoTo completes merger with TikTok Shop Indonesia

Based in Singapore, Momentum Works focuses on building, scaling, and managing tech ventures across emerging markets. The company utilizes its expertise and network to support the tech and new economy ecosystem through ventures, insights, immersions, and advisory services.

The post TikTok Shop beats Tokopedia to become SEA’s second-largest e-commerce platform appeared first on e27.