Posted 5/24/24 | May 24th, 2024

I always make sure to have travel insurance with me. With over 15 years of traveling experience, I know firsthand how crucial it is. Travel insurance has been a lifesaver for me in situations like lost luggage, canceled flights, and medical emergencies. It has also helped many of my friends and readers of my blog.

Although travel insurance is not the most exciting topic to read about, it is a vital part of trip planning. Thankfully, finding a plan that suits your needs and budget has become much easier. Many companies now offer a simple and quick process to get a quote, sign up for a plan, understand the policy details, and make a claim.

One of these companies is Freely.

What is Freely?

Freely is a travel insurance provider and safety app. Similar to other insurance companies, it offers coverage to help you in case of covered incidents while you are traveling. The base plan includes essential features such as emergency medical care, emergency evacuation coverage, trip interruption, lost baggage coverage, and 24/7 support.

However, Freely stands out by offering customization options. The base policy is affordable because it does not include unnecessary coverage. You can choose to upgrade for additional coverage, such as coverage for valuable electronics or sporting equipment if you are carrying them. This customization allows you to enhance your coverage based on your specific needs.

One unique feature of Freely is the Daily Boost supplement, which offers insurance add-ons for activities or gear that you may not need every day, like skiing, renting a car, or skydiving. These add-ons are available on a daily basis, ensuring that you only pay for the coverage when you need it.

For example, adventure activities cost only $1 USD per day, while rental car coverage is priced at $15 USD per day (prices vary by state). This flexibility allows you to tailor your policy to your exact requirements.

What Does Freely Cover?

Freely’s policies offer comprehensive coverage, including:

Emergency Medical Expenses

Provides coverage for emergency medical care in case of accidents or illnesses while traveling.

Emergency Evacuation and Repatriation

Covers the costs of medical and emergency evacuations to ensure your safety.

Emergency Dental Expense

Includes coverage for emergency dental care while on your trip.

Accidental Death and Dismemberment

Offers protection in the unfortunate event of accidental death or dismemberment.

Trip Interruption

Reimburses you if your trip is interrupted due to unforeseen circumstances.

Lost, Stolen, or Damaged Baggage

Covers lost, stolen, or damaged baggage up to a certain limit, with options to upgrade for higher coverage limits.

Baggage Delay

Provides compensation if your luggage is delayed for a certain period.

Note: It is essential to carefully read the policy details and check for any specific exclusions or limitations based on your location.

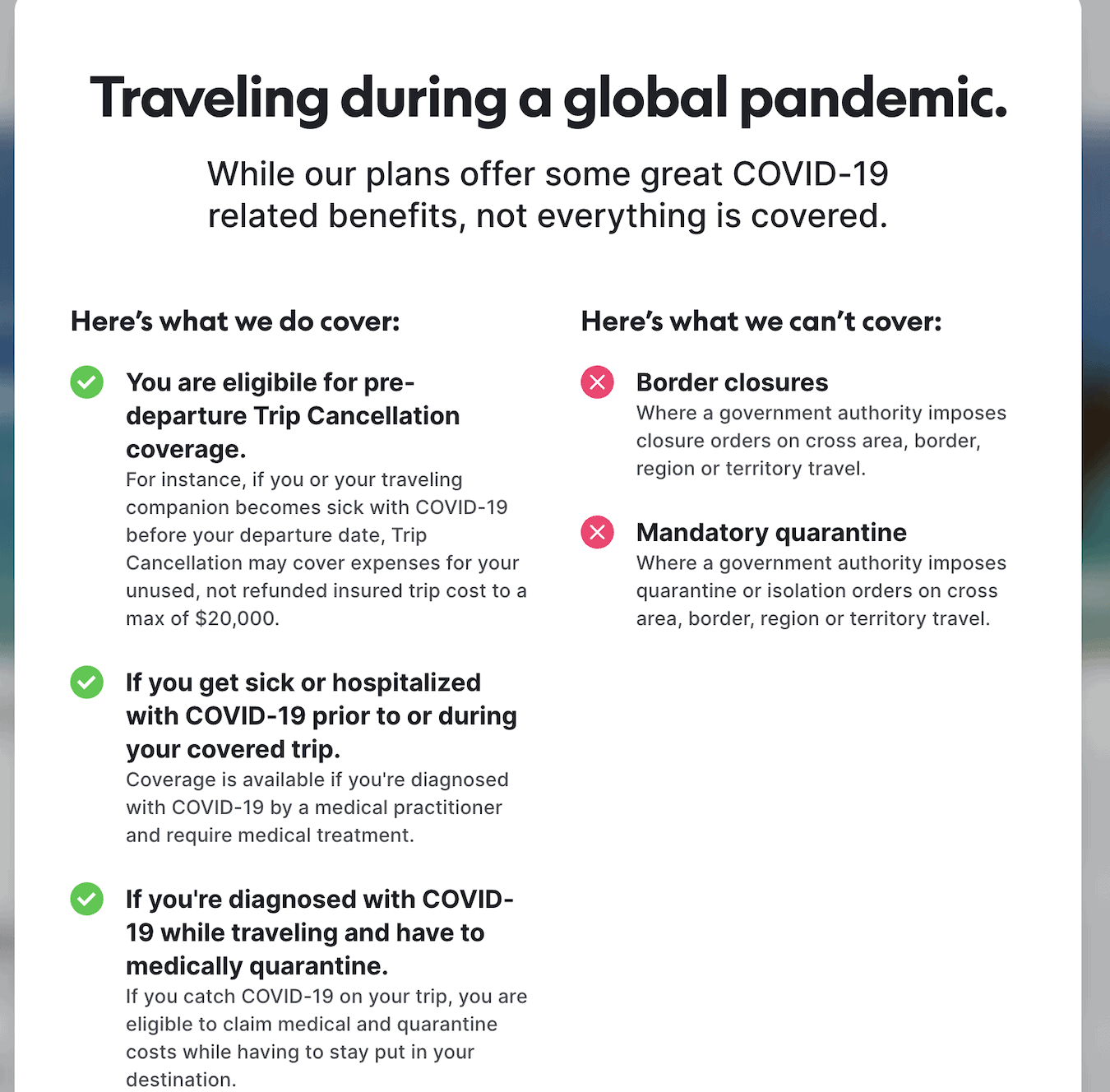

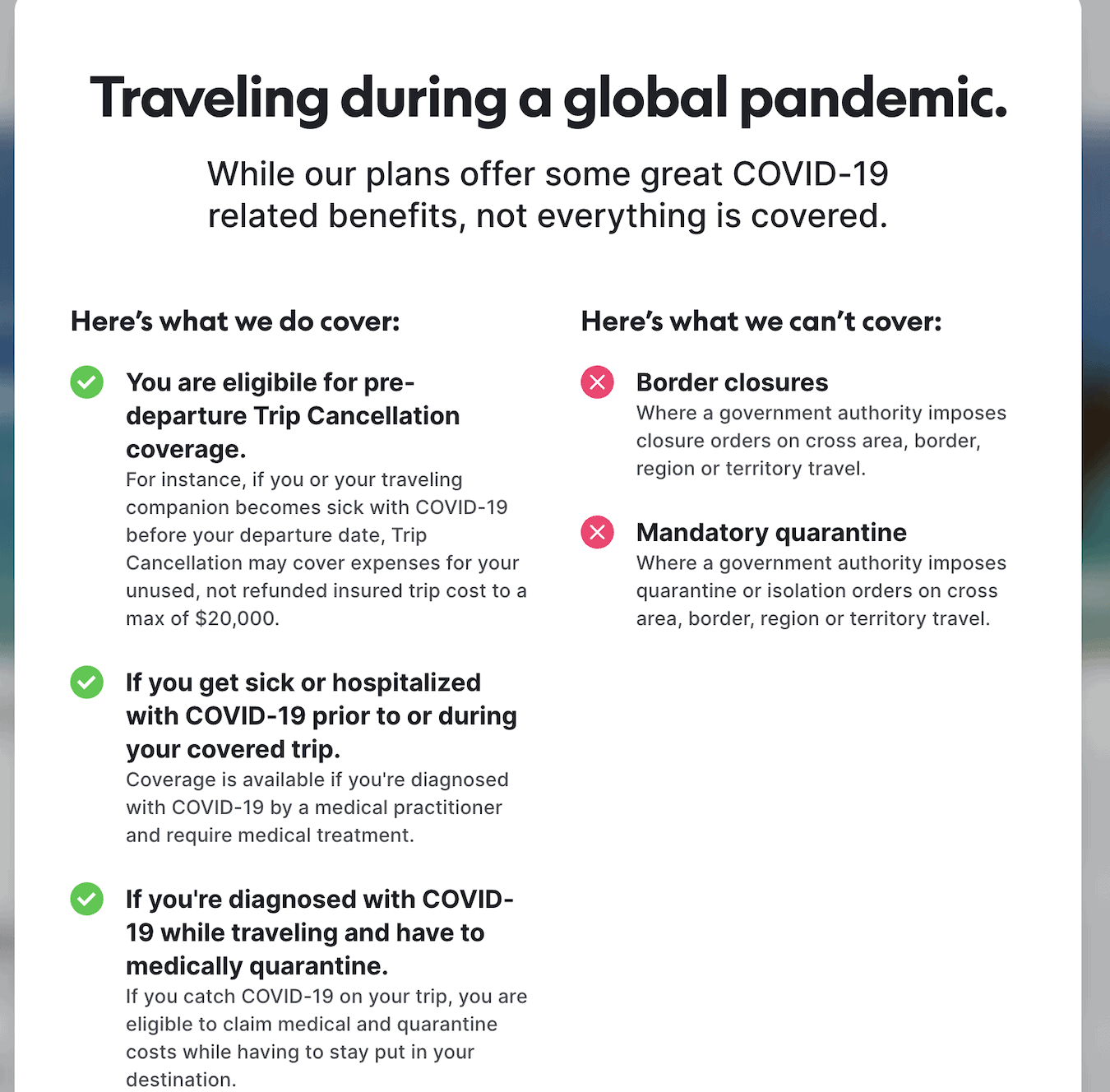

What’s NOT Covered?

While Freely covers a wide range of scenarios, it’s important to note what is not covered, such as:

- Alcohol- or drug-related incidents

- Electronics exceeding $500 USD (without additional coverage)

- Participation in certain high-risk activities

- Losses due to pre-existing medical conditions

If you have any doubts about coverage for specific activities, it’s recommended to contact Freely directly for clarification.

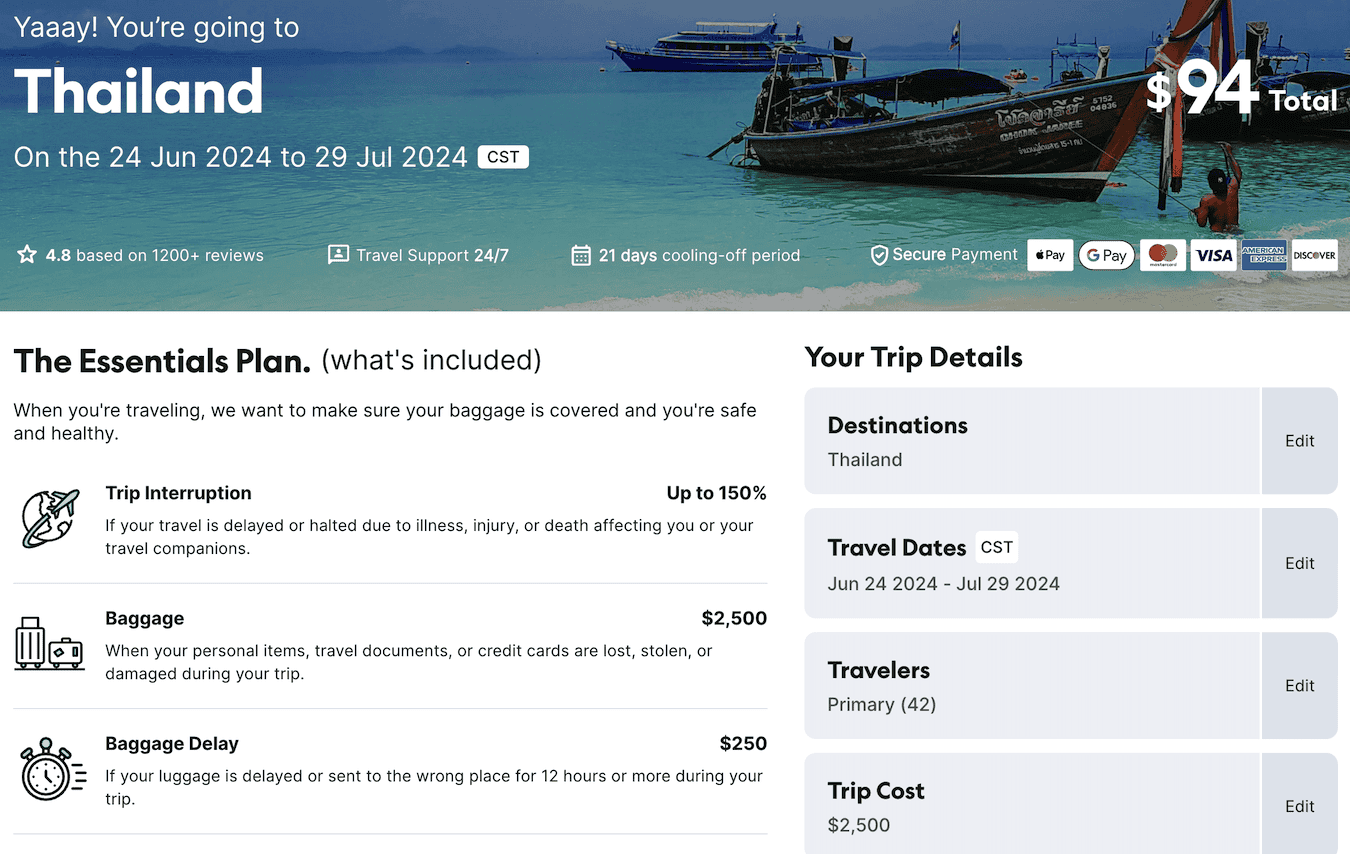

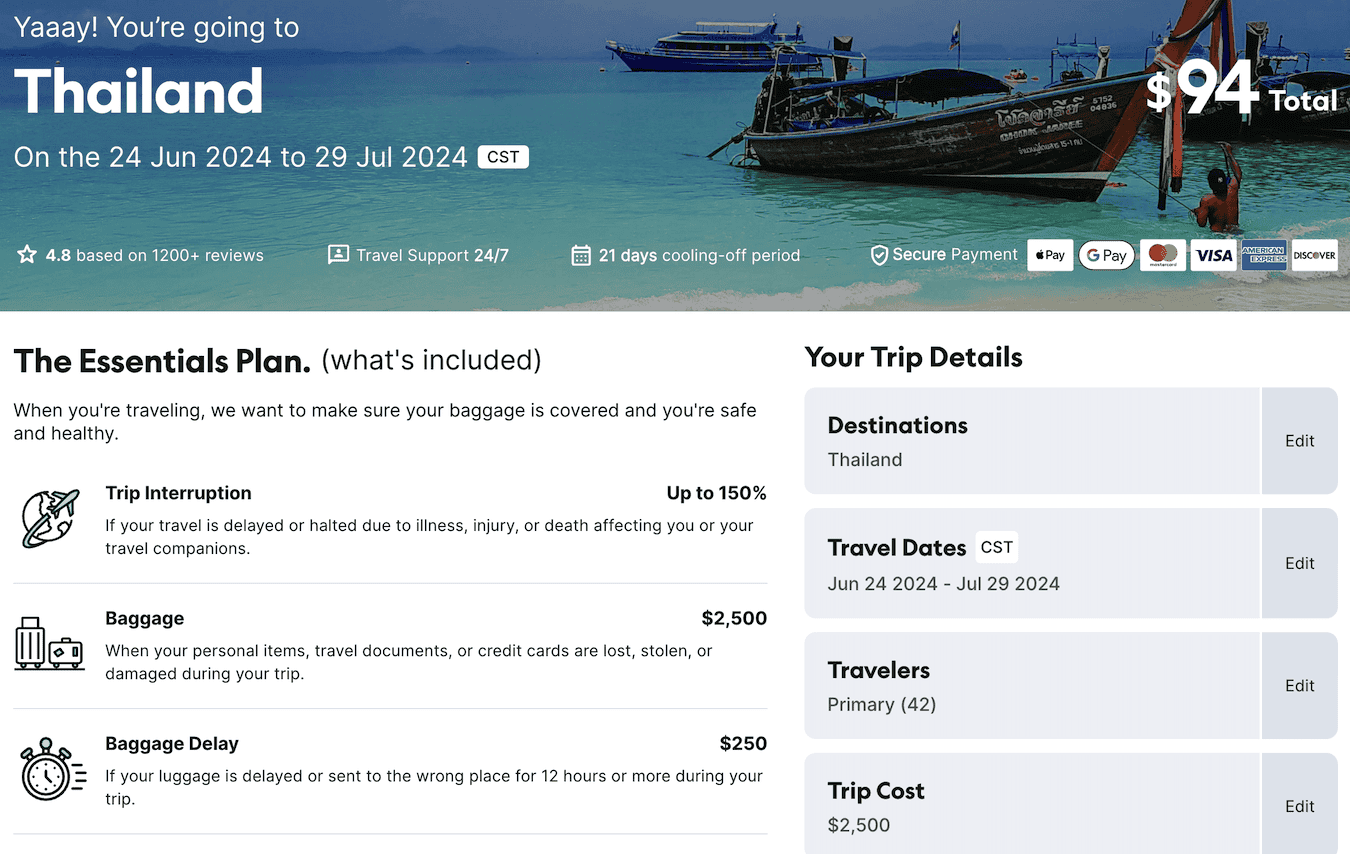

How Much Does Freely Cost?

To get a quote from Freely, visit their website and provide basic trip details. The cost of coverage will depend on factors such as your age, destination, duration of travel, and trip expenses.

For example, a 30-year-old traveler heading to Thailand for a month may expect to pay around $40 USD for the base coverage. Additional costs may apply for extras or Daily Boosts.

Click here to get a quote from Freely.

Pros of Freely

- 24/7 emergency assistance

- Comprehensive emergency medical coverage

- Flexible Daily Boost add-ons for extra gear and activities

Cons of Freely

- Available only in the US and Australia

- App download required for most services

Who is Freely For — and NOT For?

Freely is ideal for budget travelers, backpackers, and adventurous individuals looking for affordable and customizable travel insurance. The app’s features make it convenient for those who prefer to manage their policies on-the-go.

However, if you prefer not to use an app for insurance-related tasks or if you reside outside the US or Australia, Freely may not be the best fit for you.

Buying travel insurance should be a simple process, and Freely aims to make it just that. With a user-friendly app and customizable coverage options, Freely offers a promising solution for travelers seeking reliable insurance. Consider exploring Freely when researching insurance plans for your next trip.

Click here to learn more and get a quote today!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Use Skyscanner to find affordable flights that cover websites and airlines worldwide.

Book Your Accommodation

For hostels or cheap hotels, book with Hostelworld or Booking.com for the best deals.

Save Money While Traveling

Visit my resource page for money-saving tips and the best companies to use when you travel.

Travel for Free

Earn points with travel credit cards to redeem for free flights and accommodations. Explore my guide for recommendations on selecting the right card.

Find Activities for Your Trip

Discover exciting tours and activities on Get Your Guide for a memorable travel experience.